Navigating the Funding Landscape: A Comprehensive Guide for Startups

Understanding Startup Funding: An Overview Startup funding is a critical aspect of launching and scaling a new business, as it helps entrepreneurs turn their innovative

Understanding Startup Funding: An Overview Startup funding is a critical aspect of launching and scaling a new business, as it helps entrepreneurs turn their innovative

Personal Savings For new entrepreneurs, personal savings often serve as the primary and most accessible source of funding. Utilizing personal funds to finance a startup

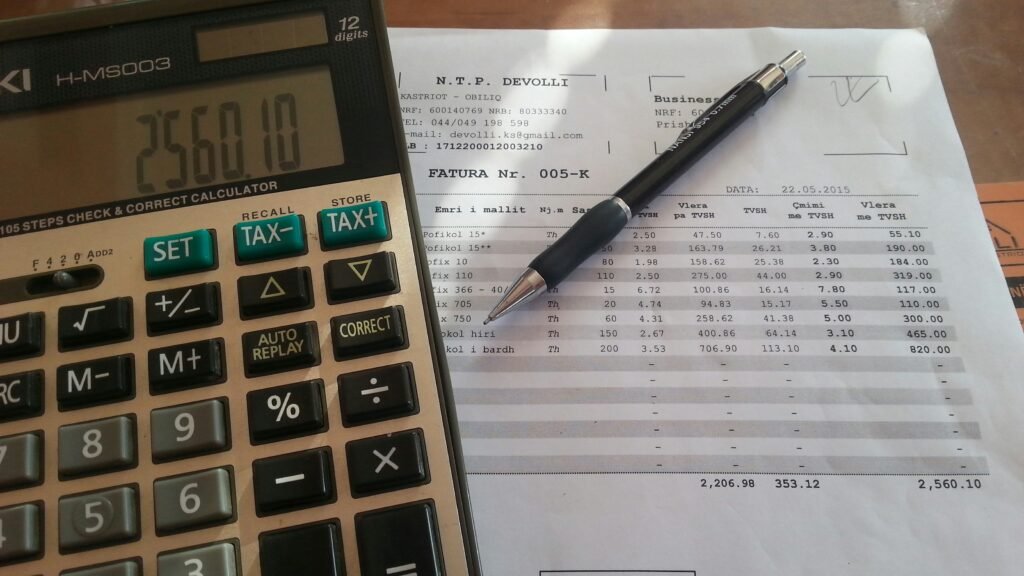

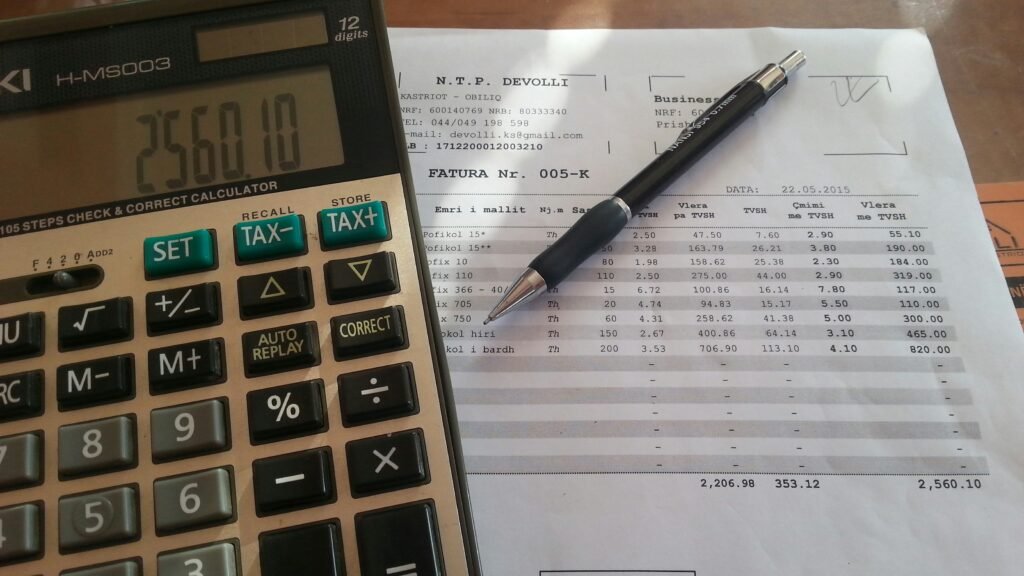

Introduction to Cash Flow Management Cash flow management is a critical aspect of financial health for both individuals and businesses. It refers to the process

Running a business in 2025 means facing rapid changes—from shifting markets to new technologies. To stay ahead, business owners need more than just great products

Introduction to Financial Statements Financial statements are formal records that represent the financial activities and position of an individual, business, or organization. They provide a

Introduction to Financial KPIs Financial Key Performance Indicators (KPIs) are vital metrics that allow entrepreneurs to measure the effectiveness of their financial strategies and overall

Understanding Startup Funding: An Overview Startup funding is a critical aspect of launching and scaling a new business, as it helps entrepreneurs turn their innovative ideas into viable commercial ventures. In the early stages of a startup, securing adequate funding is essential for covering operational costs, research and development, and marketing efforts. Understanding the different stages of startup funding can provide entrepreneurs with a roadmap for securing the necessary capital

Personal Savings For new entrepreneurs, personal savings often serve as the primary and most accessible source of funding. Utilizing personal funds to finance a startup demonstrates a strong commitment and confidence in the business concept. It reflects a readiness to take financial risks, which can encourage potential investors and lenders to believe in the venture. By investing one’s savings, entrepreneurs can showcase their belief in the project’s viability, significantly influencing

Introduction to Cash Flow Management Cash flow management is a critical aspect of financial health for both individuals and businesses. It refers to the process of tracking how much money is entering and leaving an account over a specific period. Maintaining a positive cash flow is essential as it ensures that there are sufficient funds to cover obligations and investments. For individuals, effective cash flow management enables better budgeting, debt

Running a business in 2025 means facing rapid changes—from shifting markets to new technologies. To stay ahead, business owners need more than just great products or services—they need smart financial habits. The right strategies can help you plan for the future, stay profitable, and adapt when challenges come your way.Here are three key financial habits every business owner should adopt this year to keep their business strong and growing. 1.

Introduction to Financial Statements Financial statements are formal records that represent the financial activities and position of an individual, business, or organization. They provide a structured way to assess financial performance and offer insight into the profitability, solvency, and liquidity. Understanding these documents is crucial, even for those who may be uncomfortable with numbers, as they play a vital role in financial decision-making. The three main types of financial statements

Introduction to Financial KPIs Financial Key Performance Indicators (KPIs) are vital metrics that allow entrepreneurs to measure the effectiveness of their financial strategies and overall business performance. Unlike regular metrics, which may provide a snapshot of certain data points, KPIs are specifically chosen indicators that align with the strategic goals of a business. They offer insight into critical areas such as profitability, expenses, and revenue growth, enabling entrepreneurs to make